Shoals area March home sales up 40 percent from February

Home sales in the Shoals area were slightly down compared with last March but way up from February sales. (iStock)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

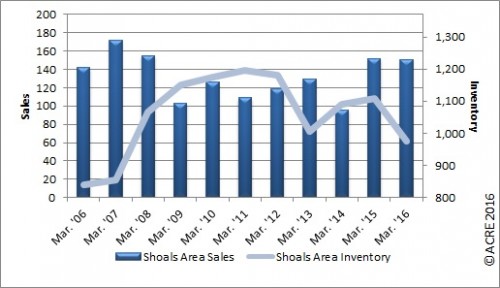

Sales: According to the Multiple Listing Service of the Shoals Area Association of Realtors, Shoals Area* residential sales totaled 151 units during March, a decrease of 0.7 percent or one unit below the same period last year. Two more resources to review: Quarterly Report and Annual Report.

For all Shoals area real estate data, click here.

Year-to-date home sales in Shoals are down 2 percent during March over last year.

Forecast: March sales landed 12 units above our monthly forecast. Alabama Center for Real Estate’s (ACRE) year-to-date sales forecast through March projected 334 closed transactions, and actual closed sales were at 346, a 3.5 percent positive difference.

Supply: Shoals Area housing inventory totaled 976 units, a decrease of 11.9 percent from March 2015. Inventory also decreased 0.2 percent from the prior month. Historical data suggests housing inventory increases generally by 1.5 percent from February to March. Inventory has favorably declined 18.5 percent from the month of March peak of 1,197units reached in 2011.

The inventory-to-sales ratio in March was 6.5 months of housing supply, a decrease of 11 percent from last March. Restated, at the Marchsales pace, it would take 6.5 months to absorb the current inventory for sale. The market equilibrium (balance between supply and demand) is considered to be approximately 6 months (not seasonally adjusted) during March.

Demand: March sales increased 40 percent from the prior month. Historical data from 2011-15 indicates typical sales increase 25.6 percent from February to March.

Pricing: The Shoals Area median sales price in March was $115,000, a decrease of 4 percent from March 2015. The median sales price also increased 1.3 percent from the prior month. This direction is consistent with historical data indicating that the March median sales price on average (2011-15) increases by 16 percent from the month of February. Pricing can fluctuate from month-to-month as the sample size of data (closed transactions) is subject to seasonal buying patterns so a broader lens as to pricing trends is appropriate and we recommend contacting a local real estate professional for additional market pricing information.

Industry perspective: “Growing pessimism over the last three months about the direction of the economy seems to be spilling over into home purchase sentiment,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “The gap between the share of consumers who think the economy is on the wrong track and the share who think it is on the right track has widened, nearly matching its reading last August, when concerns regarding China and oil prices led to the biggest stock market plunge in years. In turn, we saw dips this month in income growth perceptions, attitudes about the home-selling climate, and job confidence, all of which contributed to the lowest Home Purchase Sentiment Index reading in the last year and a half. These declines seem to be at odds with recent news of solid overall job creation, but may reflect weakening economic performance in certain industries.” For the full report, click here.

The Shoals Area Residential Monthly Report is developed in conjunction with the Shoals Area Association of Realtors to better serve its area consumers.