Click here to view or print the entire September report compliments of the ACRE Corporate Cabinet. Join the Center mailing list HERE.

Sales: Alabama residential sales totaling 4,618 units in September reflect an increase of 16.7 percent growth from the same period a year earlier. Sales for the month continue to trend upward for the state, which bottomed out at 2,788 sales in September 2010, but has improved each year since, with the exception of a slight dip in 2012. Sales are 37.4 percent above the September five-year sales average (2010-14) of 3,360 units. Year-to-date sales through September are up 14.1 percent from 2014. Two more resources to review market: Quarterly Report and Annual Report

Forecast: September sales were 17 percent or 689 units above our monthly forecast. Alabama Center for Real Estate’s (ACRE) year-to-date sales forecast through September projected 36,505 closed transactions while the actual sales were 39,085 units, a 7 percent rise.

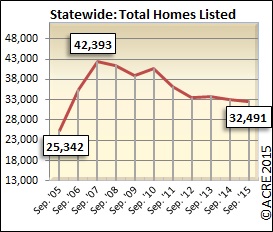

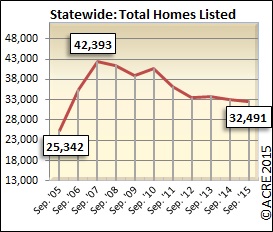

Supply has remained flat over the past four years but continued on a downward trajectory to 32,491 units listed in September for the state.

Supply: The statewide housing inventory in September was 32,491 units, a decrease of 1.5 percent from September 2014 and 23.4 percent below the September peak in 2007 (42,393 units). There was 7.0 months of housing supply in September (6 months is considered equilibrium), which represents a favorable drop of 15.6 percent from September 2014 (8.3 months). September inventory also decreased from August by 2 percent. This direction is right in line with historical data that indicates September inventory on average (2010-14) decreases from August by 2.7 percent.

Demand: September

residential sales increased 0.5 percent from the prior month. This direction contrasts with historical statewide data indicating that September sales on average (2010-14) decrease from August by 10.8 percent. The average Days on Market until a listing sold was 140 days, 5.5 percent faster than last year. Nationally, September sales were 8.8 percent above the same period last year. See more details of how Alabama compares to the broader US market

here.

Pricing: The September median sales price increased 6.5 percent from the same period last year. In September, 12 of 25, or 48 percent, of local markets experienced price gains from September 2014. Keep in mind that this indicator can fluctuate from month to month due to sampling size of data and seasonal buying patterns. The September median sales price decreased 3.4 percent from the prior month. This direction contrasts with historical data averages (2010-14) reflecting that the September median sales price increases 1.1 percent from August.

Seeking Balance: The metro markets in Alabama representing 70 percent of all sales continued to trend toward greater seller bargaining power with 6.3 months of supply. Outside the metro markets, Alabama’s mid-sized markets are reporting 7.7 months of supply, while rural areas are reporting 9.7 months of supply. With that said, there have been significant improvements from inventory peaks experienced during the recession. The supply of “quality” inventory in the past has impacted sales, according to some local professionals with boots on the ground.

National Industry Perspective: “Our forecast for the year is largely unchanged despite recent market volatility. Fundamentals are positive, suggesting potential for some improvement in the fourth quarter,” said Fannie Mae Chief Economist Doug Duncan. “While core personal consumption expenditures experienced their weakest gain in more than four years in July, real consumer spending rebounded during the month and August auto sales were stronger than they have been in a decade. Consumers may get an added boost during the year from subdued inflation given the stronger dollar and low oil prices. Overall, we anticipate economic growth of 2.4 percent for 2015, up slightly from 2.1 percent in the prior forecast. Consumer and government spending as well as nonresidential and residential investment are expected to contribute to growth while net exports and inventory investment will likely pose headwinds.” For full report click

here.

The days on the market during September also dropped for the state to 140.

Median sales price is on the rise in Alabama during September reaching $137,884 last month.

Months of supply for the state was once at 14.6 at the height of the recession, but has dropped to half that number since 2010.

Total sales have been on the rise in September since 2010, reaching over 4,000 in September.

The average sales price in Alabama during September continued to climb compared to the past five years.

###

Bryan Davis is the research/media coordinator for the Alabama Center for Real Estate housed within the Culverhouse College of Commerce at the University of Alabama. He can be reached at 205-348-5416 or at bkdavis@culverhouse.ua.edu.

The Alabama Residential Monthly Report is work product developed in conjunction with the Alabama Association of Realtors and its local associations. ACRE was founded by legislative act in 1996 due to the efforts of the Alabama Real Estate Commission, the Alabama Association of Realtors and the Office of the Dean, UA Culverhouse College of Commerce to serve the State of Alabama real estate industry and the consumers it serves. ACRE is not a state-funded entity, rather its operates in part because of the support of Alabama real estate licensees and goodwill & generosity of the ACRE Corporate Cabinet and our statewide ACRE Partners. The Alabama Association of Realtors serves as the voice of the real estate industry in Alabama. AAR is the largest statewide organization of real estate professionals who sale, lease, appraise, and develop residential, commercial, rural and resort properties.