Shoals narrowly misses new peak in home sales during December

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

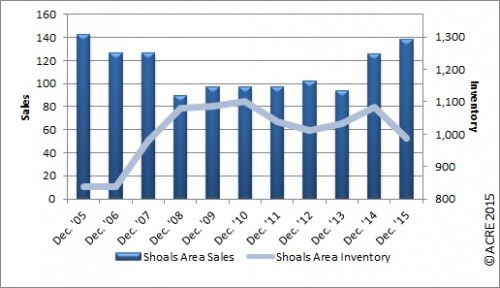

Sales: According to the Multiple Listing Service of the Shoals Area Association of Realtors, Shoals Area* residential sales totaled 138 units during December, an increase of 9.5 percent or 12 units above the same period last year. Year-to-date sales through December are up 13 percent from 2014. Two more resources to review: Quarterly Report and Annual Report.

For all Shoals area real estate data, click here.

Shoals December sales reach 138 units to close out 2015.

Forecast: December sales landed 22 units above our monthly forecast. After two months of home sales failing to meet or exceed expectations, the area finished the year strong, up 19 percent from the forecast of 116 units. Alabama Center for Real Estate’s (ACRE) year-to-date sales forecast through December projected 1,510 closed transactions while the actual sales were 1,606 units, a rise of 6 percent.

Supply: Shoals Area housing inventory totaled 988 units, a decrease of 8.8 percent from December 2014. Inventory also decreased 7.2 percent from the prior month. Historical data suggests housing inventory decreases generally by 7.4 percent from November to December. Inventory has favorably declined 10.3 percent from the month of December peak of 1,101 reached in 2010.

The inventory-to-sales ratio in December was 7.2 months of housing supply, a favorable decrease of 16.7 percent from last December. Restated, at the December sales pace, it would take 7.2 months to absorb the current inventory for sale. The market equilibrium (balance between supply and demand) is considered to be approximately 6 months (not seasonally adjusted) during December.

Demand: December sales increased 51 percent from the prior month. Historical data from 2010-14. indicates typical sales increase 17.6 percent from November to December.

Pricing: The Shoals Area median sales price in December was $116,100, a decrease of 1.6 percent from December 2014. The median sales price also decreased 1.6 percent from the prior month. This direction is consistent with historical data indicating that the December median sales price on average (2010-14) decreases by 11.2 percent from the month of November. Pricing can fluctuate from month-to-month as the sample size of data (closed transactions) is subject to seasonal buying patterns so a broader lens as to pricing trends is appropriate and we recommend contacting a local real estate professional for additional market pricing information.

Industry Perspective: “Consumers ended the year on an improved note with regard to their income, job security, and overall economic outlook. This more positive consumer sentiment brought the HPSI up a few points, moving the index up for all of 2015,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “Brightening economic prospects, if sustained, should stimulate demand for homeownership. However, continuing upward pressure on rental prices and constrained housing supply, particularly for starter homes, may mean prospective first-time homebuyers could face affordability constraints.” For full report click here.

The Shoals Area Residential Monthly Report is work product developed in conjunction with the Shoals Area Association of Realtors to better serve its area consumers. The ACRE monthly report is provided to illustrate the “general” market direction & trends when comparing prior periods with the most current available data. Real estate is local and statistics will fluctuate between areas within a city including subdivisions. ACRE recommends that you consult a local real estate professional for “specific” advice associated with your market. The Alabama Center for Real Estate‘s core purpose is to advance the real estate industry in Alabama by providing relevant resources in the areas of research, education and outreach.