Tuscaloosa year-to-date home sales up from a year ago

The Tuscaloosa median home sales price in September was $167,750, an increase of 1.1 percent compared to September 2016. (GettyImages)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

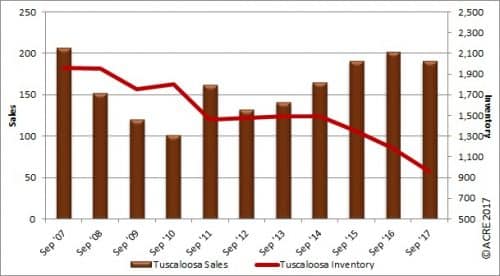

Sales: According to the Tuscaloosa MLS, Tuscaloosa-area residential sales totaled 190 units during September, down 5.5 percent from 201 homes sold during September 2016. Year-to-date sales for the first three quarters were up 4.7 percent from the same period of 2016. Two more resources to review: Quarterly Report and Annual Report.

For all of the Tuscaloosa area’s housing data, click here.

Forecast: September results were 9 units or 4.5 percent below the Alabama Center for Real Estate’s monthly forecast. ACRE’s 2017 sales forecast through September projected 2,003 closed transactions, while the actual sales were 2,015 units.

Supply: Tuscaloosa’s September housing inventory totaled 961 units, a decrease of 18.8 percent from September 2016. September inventory decreased by 0.2 percent compared to August. Historical data indicate that September inventory on average (2012-16) decreases from August by 0.7 percent. Inventory has now declined 51 percent from the September peak (1,960 units) reached in 2007.

Seeking balance: The inventory-to-sales ratio declined 29.7 percent year-over-year during September to 5.1 months. The market equilibrium (balance between supply and demand on a non-seasonally adjusted basis) is considered to be approximately 6 months.

Demand: September residential sales were 2 percent below the prior month. This is consistent with seasonal buying patterns and historical data indicating that September sales on average (2012-16) decrease from August by 22.8 percent.

Pricing: The Tuscaloosa median sales price in September was $167,750, an increase of 1.1 percent compared to September 2016. The median sales price was up 1.2 percent from August’s price. Historical data (2012-16) indicate that the median sales price in September typically decreases from August by 3.2 percent. It should be noted that differing sample size (number of residential sales of comparative months) can contribute to statistical volatility, including pricing. Consult with a real estate professional to discuss pricing, as it will vary from neighborhood to neighborhood.

Industry perspective: “The impacts from this season’s hurricanes on the U.S. economy were wide-ranging but should dissipate over time. These include the loss of momentum in consumer spending and residential investment, as well as a decline in September payrolls and August home sales and contract signings,” said Fannie Mae Chief Economist Doug Duncan. “We expect economic activity to rebound in coming months. The recovery will likely be slower for home sales and home building, however, as the labor shortage and rising material prices will likely worsen after the hurricanes, exacerbating already-tight inventory. While we expect full-year economic growth for 2017 to come in at the same rate projected in our prior forecast, we now believe that total home sales will be essentially flat this year compared with the moderate rise predicted in the prior forecast. Despite muted underlying inflation, we continue to expect the Fed to raise rates for the third time this year in December.”

Click here to generate more graphs from the Tuscaloosa September Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Tuscaloosa Residential Monthly Report is developed in conjunction with the Tuscaloosa Association of Realtors to better serve West Alabama consumers.