Mobile home sales in October up 3 percent from same month last year

The Mobile-area median home sales price in October was $141,450, an increase of 4.8 percent compared to last October. (iStock)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

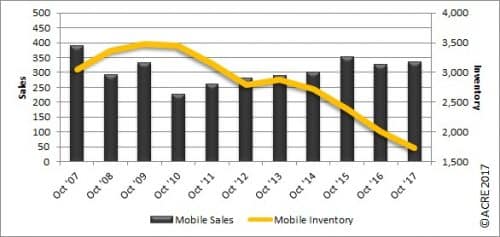

Sales: According to the Gulf Coast Multiple Listing Service, Mobile-area residential sales totaled 338 units during October, an increase of 2.7 percent from the same month last year. Total home sales in October 2016 were 329. Year-to-date sales in the area through October are down 1.3 percent from 2016. Two more resources to review: Quarterly Report and Annual Report.

Forecast: October sales were 14 units below the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE’s 2017 sales forecast through October projected 3,719 closed transactions, while the actual sales were 3,793 units.

Supply: The Mobile-area housing inventory in October was 1,730 units, a decrease of 13.6 percent from October 2016. Inventory has declined 50.4 percent from the October peak (3,485 units) reached in 2010. There were 5.1 months of housing supply last month (6 months represents a balanced market).

Demand: October sales decreased 8.4 percent from September. Historical data indicate October sales, on average (2012-16), decrease from September by 6.1 percent.

Pricing: The Mobile-area median sales price in October was $141,450, an increase of 4.8 percent compared to the median sales price from last October. The October median sales price decreased 3.4 percent when compared to September. Historical data indicate the October median sales prices typically decreased 6.5 percent from the month of September from 2012 through 2016. Pricing can fluctuate from month to month as the sample size of data is subject to seasonal buying patterns. ACRE highly recommends consulting with a local real estate professional to discuss prices, which can vary from neighborhood to neighborhood.

Industry perspective: “The first print of third-quarter economic growth showed surprising resiliency. The expected economic hit from the recent natural disasters either failed to materialize or was drowned out by business optimism,” said Fannie Mae Chief Economist Doug Duncan. “Recent data showed a stronger pickup in domestic demand than anticipated, leading us to increase our growth forecast for the final quarter of this year and coming quarters. We also revised higher our 2018 growth forecast to 2 percent. Tax cuts, if enacted, present upside risk to our growth forecast for next year but could also lead to more aggressive Fed action. Housing still remains a drag on the economy, as shortages of labor and available lots, coupled with rising building material prices, further complicate existing inventory, affordability and sales challenges.”

The Mobile Area Residential Monthly Report is developed in conjunction with the Mobile Area Association of Realtors to better serve Gulf Coast consumers.