Mobile March home sales up 6 percent over same period last year

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

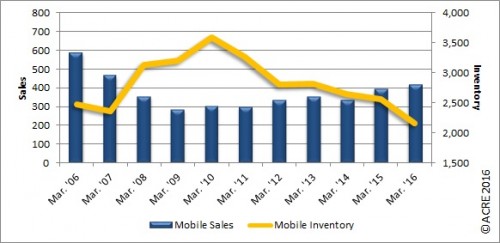

Sales: According to the Gulf Coast Multiple Listing Service, Mobile-area residential sales totaled 416 units during March, an increase of 6.1 percent from the same period last year (24 units). Two more resources to review: Quarterly Report and Annual Report.

For all of Mobile’s area housing data, click here.

Forecast: March sales were 18 units, or 4.2 percent, above the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE’s year-to-date sales forecast through March projected 983 closed transactions, while the actual sales were 959 units, an unfavorable difference of 2 percent.

Home sales in Mobile during March were 22.5 percent above the five-year average of 340 units (2011-15).

Supply: The Mobile-area housing inventory in March was 2,152 units, a decrease of 16 percent from March 2015. Inventory has now declined 40 percent from the March peak (3,593 units) reached in 2010. There was 5.2 months of housing supply in March 2016 (6 months represents a balanced market for this time of year) vs. 6.5 months of supply in March 2015, a favorable decline of 21 percent. The market continues to move toward equilibrium, where buyer and seller have equal bargaining power, which is encouraging news.

March inventory in the Mobile area also decreased 1.5 percent from the prior month. As seller confidence in the housing market continues to gradually strengthen, more listings for sale can be anticipated in the future, including more home construction. This is important because the quality of inventory has become a market impediment, according to recent surveys.

Demand: March sales increased 50 percent from the prior month. This direction is consistent with historical data, which indicate sales, on average (2011-15), increased from February by 35.8 percent.

Existing single-family home sales accounted for 83 percent (down from 87 in March 2015) of total sales, while 10 percent (unchanged from March 2015) were new home sales and 7 percent (up from 3 percent in March 2015) were condo transactions.

Pricing: The Mobile area median sale price in March was $125,500, down 1.5 percent from last March. The March median sale price increased 8 percent when compared to the prior month. This month-over-month direction contrasts with historical data (2011-15) indicating, on average, March median sale prices decrease from February by 0.5 percent. Pricing can fluctuate from month to month as the sample size of data (closed transactions) is subject to seasonal buying patterns. ACRE highly recommends consulting with a local real estate professional to discuss prices, which can vary from neighborhood to neighborhood.

Industry perspective: “Growing pessimism over the last three months about the direction of the economy seems to be spilling over into home purchase sentiment,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “The gap between the share of consumers who think the economy is on the wrong track and the share who think it is on the right track has widened, nearly matching its reading last August, when concerns regarding China and oil prices led to the biggest stock market plunge in years. In turn, we saw dips this month in income growth perceptions, attitudes about the home selling climate, and job confidence, all of which contributed to the lowest HPSI reading in the last year and a half. These declines seem to be at odds with recent news of solid overall job creation, but may reflect weakening economic performance in certain industries.”

The Mobile Area Residential Monthly Report is work product developed in conjunction with the Mobile Area Association of Realtors to better serve Gulf Coast consumers.