Mobile airport’s ‘articulated strategy’ driving air traffic gains

Under a new deal, American Airlines will bring larger planes with two-class cabin service to Mobile Regional Airport. (Contributed)

One airline’s deal for expanded service stands to nearly double the gains in traffic Mobile Regional Airport has seen since 2010, and leaders contend the surge is by design.

“Air service and economic development have a lot in common. You have to have a plan for each. If you don’t have an articulated strategy for each, then you’re relying solely on luck, and that’s not how we do things,” said Roger Wehner, executive director of the Mobile Airport Authority.

The authority, which oversees Mobile Regional, Mobile Downtown Airport and Mobile Aeroplex at Brookley, announced Jan. 12 a major upgrade to American Airlines’ service at Mobile Regional, allowing for the addition of 80,000 airline seats via larger planes – with two-class cabin services – to American’s Dallas and Charlotte hubs. Both routes are served by 50-seat CRJ-200 jets. Beginning March 6, the three Dallas flights will be served with 76-seat CRJ-900 jets, each with nine first-class seats. Two of the four Charlotte jets will be upgraded to 65-seat CRJ-700 jets beginning April 4, and those planes have nine first-class seats.

The authority, which oversees Mobile Regional, Mobile Downtown Airport and Mobile Aeroplex at Brookley, announced Jan. 12 a major upgrade to American Airlines’ service at Mobile Regional, allowing for the addition of 80,000 airline seats via larger planes – with two-class cabin services – to American’s Dallas and Charlotte hubs. Both routes are served by 50-seat CRJ-200 jets. Beginning March 6, the three Dallas flights will be served with 76-seat CRJ-900 jets, each with nine first-class seats. Two of the four Charlotte jets will be upgraded to 65-seat CRJ-700 jets beginning April 4, and those planes have nine first-class seats.

The gains have been more than a year in the making. Wehner, a former director of international economic development for Alabama Power Co. and former vice president for business development for Safran USA, knows a thing or two about long-term strategy.

“In late 2015, we crafted a plan, which included assembling the right team to continue to build strong relationships with our current airline partners to grow capacity and add new destinations. We will also actively pursue new airlines and routes to provide service to this underserved region of the Gulf Coast,” Wehner said, noting Mobile Regional “is incentivized by every conceivable metric to grow passenger traffic.”

“We have been seeing very positive numbers for several months. Our average air fare has gone down by almost $100 per round trip. This most recent news is clear evidence that our strategy is having impact; the trend and results are real and growing,” Wehner said.

Spurring competition

The strategy’s primary goal, he said, is to create competition among existing carriers but not at the expense of any single partner.

“We were certainly unhappy with where we were, so we deployed a very programmatic and thoughtful approach at the beginning of 2016, and we think our numbers are at least indicative of the success we’ve had in 2016. The idea of a silver bullet out there is one approach, but we believe if you just know your business – your customers, your partners – and drive a strategy, you get results. Lo and behold, we have, and we don’t expect this to change,” Wehner said. “Competition has been created, prices have dropped and the pie is getting bigger for everyone, so no one lost.”

A major deal with American Airlines will bring 80,000 additional seats to the airline’s flights at Mobile Regional Airport. (Contributed)

The announcement comes on the heels of seven consecutive months of air traffic growth at Mobile Regional and a record-setting 26,713 passengers boarding commercial aircraft there this past November, marking the largest year-over-year increase in more than 20 years. If the trend holds up through the final numbers, passengers in 2016 could hit the 600,000 mark, when incoming traffic is added — an 8 percent increase from the record low of 554,464 in 2010.

In turn, the 80,000 extra seats the American deal brings to the market not only reflect the airline’s confidence in Mobile but also hit the growth strategy’s second goal of recapturing the existing market by luring larger aircraft with two-class service. New aircraft and routes represent the longer-term third and fourth priorities.

Shooting for 1 million

Once all four goals are attained, Brian Belcher, the authority’s director of marketing and air service development, is confident Mobile Regional can eclipse its early 2001 “high-water mark” of roughly 850,000 annual seats.

“I’m a firm believer we can get to 1 million (seats) with the right mix of destinations and carriers,” he said.

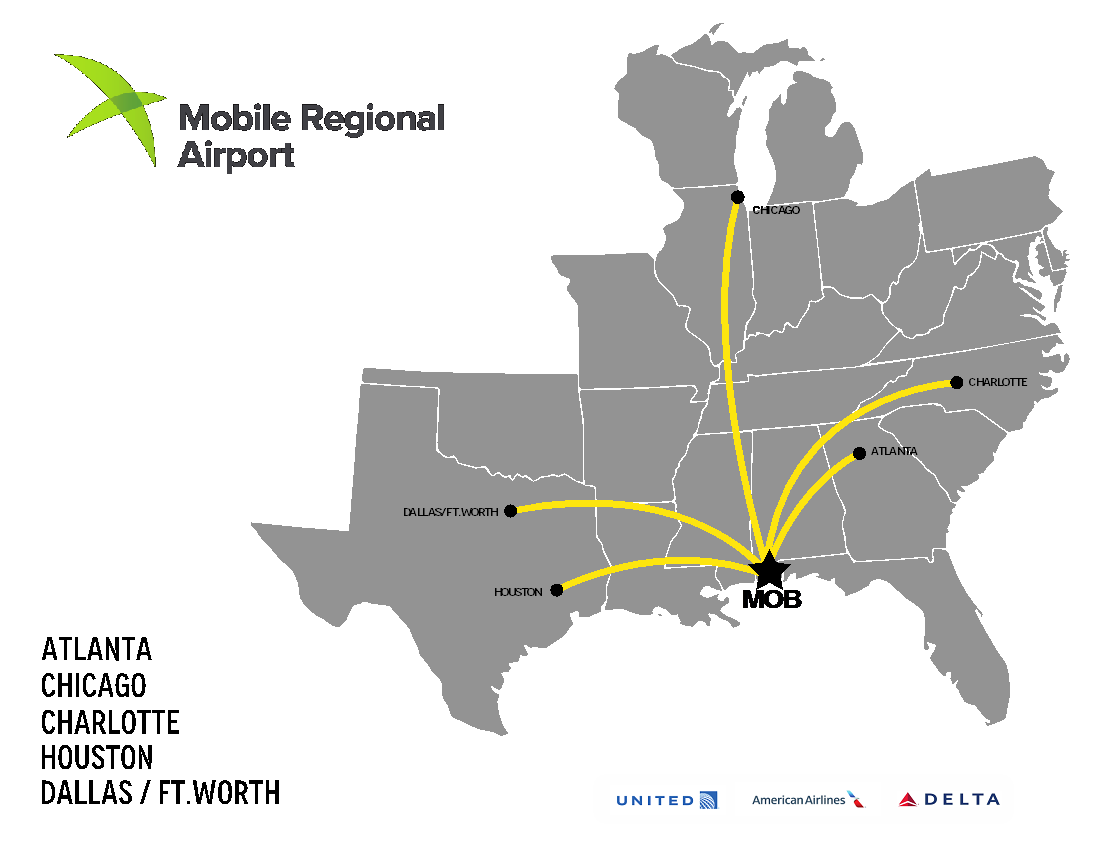

In addition to American Airlines, Mobile Regional is served by Delta Air Lines and United Airlines, which combine to serve five nonstop destinations from the Port City to Atlanta, Charlotte, Chicago, Dallas and Houston. A true “low-cost carrier” has not operated out of Mobile since AirTran left in 1998 when it was acquired by Southwest Airlines, but the authority has identified at least three “near-term” targets for that option.

Belcher said a key is to attract routes that “make sense for Mobile,” and while nonstop flights to New York are a target coveted by a large percentage of Mobile flyers, service to the Washington, D.C./Baltimore, Maryland, area is a shorter-term target. Meanwhile, Memphis is emerging as a strong contender.

Belcher said Mobile is perfectly positioned between New Orleans, Louisiana, and Fort Walton, Florida, to capture low-fare passengers whose carriers operating in those cities service Orlando, Fort Lauderdale, Las Vegas and Baltimore/D.C.

Although the figures are beginning to shift slightly, Belcher said Mobile Regional’s traffic still leans heavily on the business-passenger side at a roughly 85-15 split.

A substantial portion of those business travelers are international flyers, bolstered primarily by Mobile’s strong foreign-direct investment and Port City status. While most markets of Mobile’s size attract an average of 8 percent international travelers, Mobile Regional’s international passengers total 25 percent.

‘Tell the story’

Wehner said while Airbus and its $600 million A320 manufacturing facility have boosted international traffic, attributing the increase to Airbus alone discounts a host of industrial heavy-hitters ranging from specialty shipbuilding to chemical production.

The bottom line, Belcher said, is that the air service strategy is getting results and stands only to improve once carriers see the return on investment.

“The carriers love Mobile. They were happy flying the routes and aircraft they already had here because they were all profitable,” Belcher said. “But when you start moving that needle, like we’re doing now, you can’t just do it and hope the world notices. You have to tell the story, every little success. Every new plane. Every new route. They all add up, and that’s how you show the carriers they can do bigger and better things.”