Gadsden-area December home sales increase 6.5 percent from 2016

The Gadsden-area median home sales price in December was $124,500, a 14.1 percent increase from December 2016. (ACRE)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

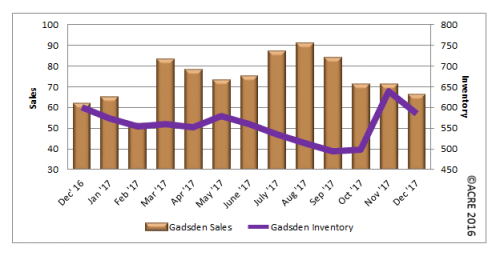

Sales: According to the Valley Multiple Listing Service, Gadsden-area residential sales totaled 66 units during December, an increase of 6.5 percent compared to the 62 units sold during December 2016. Year-to-date sales through December were 4.3 percent below 2016. Two more resources to review: Quarterly Report and Annual Report.

Click here to view all of the Alabama Center for Real Estate’s Gadsden residential data.

Forecast: ACRE’S 2017 sales forecast through December projected 866 closed transactions for the Gadsden area, while the actual sales were 896 units. Actual sales were 3.5 percent above ACRE’s forecast for the month.

Supply: Gadsden-area housing inventory totaled 585 units in December, a decrease of 2.5 percent from the 600 homes listed for sale in December 2016. The five-year average for total homes for sale in the Gadsden area in December is 677 units.

Demand: December residential sales decreased 7 percent from November. Historical data indicate that December residential sales on average (2012-2016) decrease from the month of November by 4.6 percent. Residential sales in the Gadsden area averaged 124 days on the market in December, an 18.4 percent decrease from the 152 days on the market in December 2016.

Seeking balance: The inventory for sale divided by the current monthly sales volume equals the number of months of supply. There were 8.9 months of supply in the Gadsden area during December, down from 9.7 months of supply in December 2016. Restated, at the December sales pace, it would take 8.9 months to absorb the current inventory for sale. The market equilibrium, or balance between supply and demand, is considered by most real estate professionals to be approximately 6 months.

Pricing: The Gadsden-area median sales price in December was $124,500, a 14.1 percent increase from December 2016, when the median sales price was $109,150. The median sales price decreased 5.7 percent from the prior month. Pricing can fluctuate from month to month as the sample size of data (closed transactions) is subject to seasonal buying patterns. ACRE recommends contacting a local real estate professional for additional market pricing information.

Industry perspective: “2017 ushered in with an outlook of uncertainty on the heels of the 2016 national elections, but 2017 went out with an exclamation punctuation mark of growth,” said KC Conway, director of research and corporate engagement at the Alabama Center for Real Estate (ACRE). Conway said 2017 “was the year we have waited a decade for since the onset of the 2006-2007 housing crisis. U.S. GDP turned in back-to-back quarters of more than 3 percent growth in Quarter 2 and Quarter 3; and 2017 will be the first year in a decade that the U.S. turned in an annual GDP growth rate north of 2 percent. It was just 1.7 percent in 2016. 2018 will see 2.5 to 3 percent GDP growth.

“Employment growth is a good-news story as well. The ADP National Employment Report is this economist’s go-to monthly jobs report as it is based on rich primary data – not a survey, as in the case of BLS jobs report. The January ADP report revealed more than 250,000 jobs created in the month of December (compared with 148,000 in the BLS year-end jobs report). ADP job growth for the trailing three months (more than 224,000 jobs), six months (more than 199,000 jobs), and 12 months (more than 212,000 jobs) were all at or above 200,000 jobs per month. This trend should continue through 2018.

“Heading into 2018, the more important questions to answer for Alabama Realtors are:

- What do the real estate metrics look like?

- Will home builders finally be confident enough to start more inventory?

- Will the Fed ruin the good times with more rate hikes in 2018?

“With respect to the real estate market conditions and home-builder confidence, the National Association of Home Builders (NAHB) Housing Market Index (HMI) is your best barometer of things to come. The HMI is a monthly survey of NAHB members to take their pulse on the single-family housing market and rate conditions for the sale of new homes over the coming six months. In December 2017, the HMI registered 74 — the second-best reading since 1985 and best since December 1998. A reading above 50 reflects growth. The December 2017 reading of 74 compares to a record low of just 8 in January 2010. We have come a long way since 2009-2010.

“With respect to home-building activity in Alabama during 2018, some perspective on 2017 is fruitful. In 2017, Alabama issued 13,200 permits in the January to November period – of which 11,200 were for single-family residences and 2,000 multifamily units. Breaking down the Alabama permit activity, Huntsville has overtaken Birmingham for the most total housing permits with 2,804 (2,422 single family versus 382 multifamily). The top five metropolitan statistical areas for housing permit activity during 2017 through November were:

- Huntsville with 2,804 total permits.

- Birmingham with 2,746 permits.

- Daphne-Foley with 1,699 total permits.

- Auburn with 1,292 total housing permits.

- Tuscaloosa with 976 total new permits.

“Finally, will the Fed ruin the good times with too many rate hikes? In short, the answer is no. However, the Fed is worth watching in 2018 as it is a new cast of characters led by a new chairman (Chairman Jerome Powell has yet to be confirmed by the Senate but is expected to take over in February or March from existing Chair Janet Yellen). The Fed is not likely to depart from rate hikes in 2018 (expect three, maybe four, starting in March due to higher GDP and tighter labor markets). Communicate now with your prospective spring home buyers as the 10-Year Treasury is rising. It is already threatening a 2.6 percent level. Thirty-year mortgage rates will climb above 4 percent in 2018. New home builders can manage rate increases by curtailing amenities in the new home to buy-down the mortgage rate to 4 percent or below. New home activity will not be impacted, but existing home listings will have a disadvantage unless sellers are willing to contribute toward points to also buy down the rate. Dust off your playbook as to how this works so you don’t lose a sale in 2018. Home-price appreciation is strong and ran above 6 percent in 2017. It will remain strong (above 5 percent) in 2018 despite signs that more inventory is going to be put in the ground during the spring 2018 months.”

Click here to generate more graphs from the Gadsden December Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Gadsden Residential Monthly Report is developed in conjunction with the Etowah-Cherokee County Association of Realtors to better serve its area consumers.