Shoals area sales up 3 percent in March over last year

In addition to the year-over-year increase, March sales were up 29 percent from February. (iStock)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

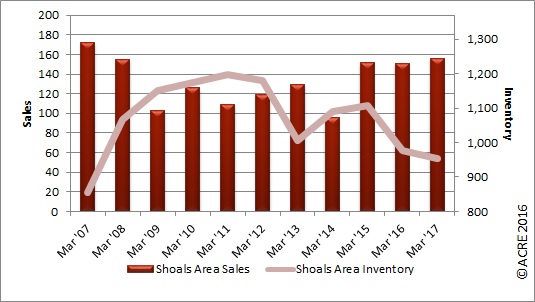

Sales: According to the Multiple Listing Service of the Shoals Area Association of Realtors, Shoals area residential sales totaled 156 units during March, up 3 percent from the same month in 2016. Another resource to review is the Annual Report.

For all Shoals-area real estate data, click here.

Forecast: March’s 156 home sales were five units or 3 percent above the Alabama Center for Real Estate’s monthly forecast. ACRE’s 2017 sales forecast through March projected 360 closed transactions, and actual closed sales were at 362.

Forecast: March’s 156 home sales were five units or 3 percent above the Alabama Center for Real Estate’s monthly forecast. ACRE’s 2017 sales forecast through March projected 360 closed transactions, and actual closed sales were at 362.

Supply: Shoals area housing inventory totaled 955 units, a decrease of 2 percent from March 2016. Inventory has declined 20 percent from the March peak of 1,197 units in 2011.

The inventory-to-sales ratio in February was 6.1 months of housing supply, down 23 percent from March 2016. Restated, at the March sales pace, it would take 6.1 months to absorb the current inventory for sale. The market equilibrium (balance between supply and demand) is considered to be approximately 6 months during March.

Demand: March sales increased 29 percent from the prior month. Historical data from 2012-16 indicate sales typically increase 27 percent from February to March.

Pricing: The Shoals area median sales price in March was $110,500, a 4 percent decrease from $115,000 in March 2016. The median sales price was 17 percent below the prior month. This direction contrasts with historical data indicating that the March median sales price on average (2012-16) increases by 14 percent from February. Pricing can fluctuate from month to month as the sample size of data (closed transactions) is subject to seasonal buying patterns. ACRE recommends contacting a local real estate professional for additional market pricing information.

Industry perspective: “Our economic forecast remains in a conservative holding pattern as we await word on the particulars of the new Administration’s plans for fiscal stimulus,” said Fannie Mae Chief Economist Doug Duncan. “In the meantime, economic sentiment from most industry stakeholders continues to reach new heights: consumers, as demonstrated by our National Housing Survey, are more positive than at any time since the survey’s inception in 2010 about the direction of the economy, while homebuilders’ optimism remains near an 11-year high. Tight inventory remains a boon to home prices and Americans’ net worth, but it also continues to price out many would-be first-time homebuyers. However, our research suggests that aging millennials, now boasting higher real wages, are beginning to narrow the homeownership attainment gap.”

Click here to generate more graphs from the Shoals March Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Shoals Area Residential Monthly Report is developed in conjunction with the Shoals Area Association of Realtors to better serve its area consumers.