Shoals area home sales in February up 3 percent over the same period in 2015

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

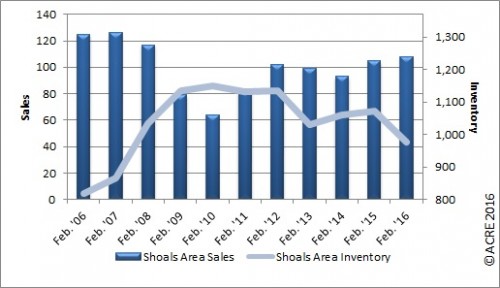

Sales: According to the Multiple Listing Service of the Shoals Area Association of Realtors, Shoals Area* residential sales totaled 108 units during February, an increase of 3 percent or three units below the same period last year. Two more resources to review: Quarterly Report and Annual Report.

For all Shoals area real estate data, click here.

There were 108 units sold in Shoals during the month of February.

Forecast: February sales landed two units above our monthly forecast. Alabama Center for Real Estate’s (ACRE) year-to-date sales forecast through February projected 195 closed transactions, which is exactly where Shoals is as of February.

Supply: Shoals Area housing inventory totaled 978 units, a decrease of 9 percent from February 2015. Inventory also decreased 0.2 percent from the prior month. Historical data suggests housing inventory increases generally by 3.7 percent from January to February. Inventory has favorably declined 15 percent from the month of February peak of 1,149 units reached in 2010.

The inventory-to-sales ratio in February was 9.1 months of housing supply, a decrease of 11 percent from last February. Restated, at the February sales pace, it would take 9.1 months to absorb the current inventory for sale. The market equilibrium (balance between supply and demand) is considered to be approximately 6 months (not seasonally adjusted) during February.

Demand: February sales increased 24 percent from the prior month. Historical data from 2011-15 indicates typical sales increase 15.6 percent from January to February.

Pricing: The Shoals Area median sales price in February was $113,500, a decrease of 4 percent from February 2015. The median sales price also decreased 5.4 percent from the prior month. This direction is consistent with historical data indicating that the February median sales price on average (2011-15) decreases by 10 percent from the month of January. Pricing can fluctuate from month-to-month as the sample size of data (closed transactions) is subject to seasonal buying patterns so a broader lens as to pricing trends is appropriate and we recommend contacting a local real estate professional for additional market pricing information.

Industry Perspective: “Our February results show the most modest consumer home price expectations since late 2012,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “For consumers who think it’s a bad time to buy a home, whose share has trended up from its recent low last November, high home prices have been an increasingly contributing factor. A slower pace of home price appreciation may provide some relief for potential homebuyers, especially first-time buyers who couldn’t reap the benefits of selling a home at high prices to buy another one.” For the full story, click here.

The Shoals Area Residential Monthly Report is work product developed in conjunction with the Shoals Area Association of Realtors to better serve its area consumers.