Tuscaloosa continues home sales growth with strong start to 2017

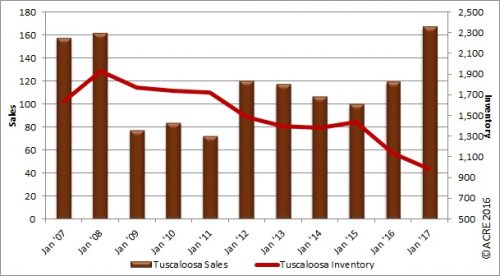

The Tuscaloosa housing market has regained its balance between buyers and sellers in the past year, with a favorable 38 percent reduction in the inventory-to-sales ratio from January to January. (Bryan Davis/ACRE)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

Sales: According to the Tuscaloosa MLS, Tuscaloosa-area residential sales totaled 167 units during January, up 40 percent from the same month in 2016. Tuscaloosa started the prior year with 119 home sales. Two more resources to review: Quarterly Report and Annual Report.

For all of the Tuscaloosa area’s housing data, click here

Forecast: January results were 25 units or 17 percent above the Alabama Center for Real Estate’s monthly forecast. ACRE’s 2016 sales forecast through January projected 142 closed transactions, while the actual sales were 167 units.

Inventory dipped below 1,000 units in January, while sales grew year-over-year by 40 percent in Tuscaloosa.

Supply: Tuscaloosa January housing inventory totaled 987 units, a decrease of 13 percent from January 2016. January inventory dipped by 2 percent compared to December. Historical data indicate that January inventory on average (2012-16) increases from December by 5.2 percent. Inventory has now declined 49 percent from the January peak (1,930 units) reached in 2008.

Seeking balance: The inventory-to-sales ratio declined 38 percent year-over-year during January to 5.9 months. Restated, at the January sales pace, it would take 5.9 months to absorb the current inventory for sale. The market equilibrium (balance between supply and demand on a non-seasonally adjusted basis) is considered to be approximately 6 months during January.

Demand: January residential sales were 8.2 percent below the prior month. This is consistent with seasonal buying patterns and historical data indicating that January sales on average (2012-16) decrease from December by 18.5 percent. Existing single-family home sales accounted for 81 percent of total sales (unchanged from January 2016), while 9 percent were new home sales (down from 12 percent in 2016) and 10 percent were condo sales (up from 7 percent).

Pricing: The Tuscaloosa median sales price in January was $149,900, a decrease of 3 percent compared to January 2016. The median sales price was also down 12 percent from December’s price. Historical data (2012-16) indicate that the median sales price in January typically decreases from December by 4.5 percent. It should be noted that differing sample size (number of residential sales of comparative months) can contribute to statistical volatility, including pricing. Consult with a real estate professional to discuss pricing, as it will vary from neighborhood to neighborhood.

Industry perspective: “We expect housing to remain resilient and continue its recovery in 2017, with affordability standing out as the industry’s greatest obstacle, particularly for first-time homeowners,” said Fannie Mae Chief Economist Doug Duncan. “Demographic factors, however, are positive. Our research shows that older millennials have begun to buy homes and close the homeownership attainment gap with their predecessors.”

Click here to generate more graphs from the Tuscaloosa January Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Tuscaloosa Residential Monthly Report is developed in conjunction with the Tuscaloosa Association of Realtors to better serve West Alabama consumers.