Cullman May home sales jump from previous month, year

Cullman's housing inventory has been reduced 75 percent since the 2011 peak, good news for anyone who's selling a home. (iStock)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

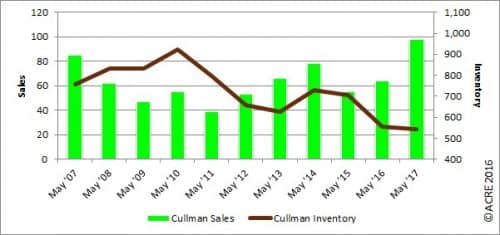

Sales: According to the Cullman MLS, Cullman County area residential sales totaled 98 units during May, up 53 percent from the same month a year earlier. Two more resources to review: Quarterly Report and Annual Report.

For all of Cullman’s real estate data, click here.

Demand: May residential sales increased 24 percent from the prior month. This direction contrasts with historical data indicating that May sales on average (2012-16) decrease from April by 10.6 percent.

Demand: May residential sales increased 24 percent from the prior month. This direction contrasts with historical data indicating that May sales on average (2012-16) decrease from April by 10.6 percent.

Forecast: May sales were 26 units or 36 percent above the Alabama Center for Real Estate’s monthly forecast. ACRE’s 2017 sales forecast through May projected 320 closed transactions, while the actual sales were 340, a favorable difference of 6 percent.

Supply: Cullman County area housing inventory totaled 524 units, 11 percent below the supply in May 2016. The inventory-to-sales ratio in May was 5.3 months of housing supply. Restated, at the May sales pace, it would take 5.3 months to absorb the current inventory for sale. This is 75 percent lower than the 2011 peak (21.3 months of supply). The market equilibrium (balance between supply and demand) for May is approximately 6 months.

Pricing: The Cullman County median sales price in May was $128,900, a decrease of 0.8 percent from May 2016 ($129,900). The median sales price was 0.8 percent below the prior month. This direction is consistent with historical data (2012-16) reflecting that the May median sales price on average decreases from April by 1.7 percent. Pricing can fluctuate from month to month as the sample size of data (closed transactions) is subject to seasonal buying patterns. ACRE recommends consulting a local real estate professional.

Industry perspective: “Once again, our full-year growth forecast remains intact as the economy grinds along, with the prospect of material policy changes appearing to be delayed,” said Fannie Mae Chief Economist Doug Duncan. “We expect consumer spending to resume its role as the biggest driver of growth in the second quarter amid improvements in the labor market. Positive demographic factors should continue to reshape the housing market, as rising employment and incomes appear to be positively influencing millennial homeownership rates. However, the tight supply of homes for sale continues to act as both a boon to home prices and an impediment to affordability.”

Click here to generate more graphs from the Cullman May Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Cullman County Residential Monthly Report is developed in conjunction with the Cullman Association of Realtors to better serve Cullman-area consumers.