Mobile June home sales up 10 percent over last year

The Mobile-area median sales price in June was up 6 percent from last June. (iStock)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

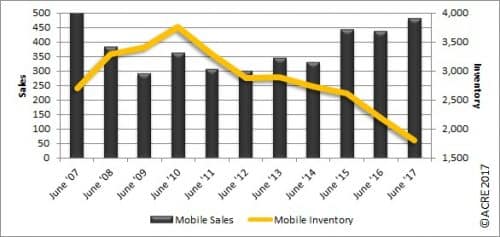

Sales: According to the Gulf Coast Multiple Listing Service, Mobile-area residential sales totaled 480 units during June, an increase of 10 percent from the same month last year. Total 2016 home sales in June were 437. Year-to-date sales in the area through June are down 1.4 percent from 2016. Two more resources to review: Quarterly Report and Annual Report.

For all of Mobile’s area housing data, click here.

Forecast: June sales were 55 units, or 13 percent, above the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE’s 2017 sales forecast through June projected 2,208 closed transactions, while the actual sales were 2,224 units.

Forecast: June sales were 55 units, or 13 percent, above the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE’s 2017 sales forecast through June projected 2,208 closed transactions, while the actual sales were 2,224 units.

Supply: The Mobile-area housing inventory in June was 1,810 units, a decrease of 17.5 percent from June 2016. Inventory has declined 52 percent from the June peak (3,757 units) reached in 2010. There were 3.8 months of housing supply last month (6 months represents a balanced market for this time of year), down from 5 months in June 2016.

Demand: June sales increased 115 units from May. This direction contrasts with historical data, which indicate June sales, on average (2012-16), decrease from May by 4.1 percent.

Pricing: The Mobile-area median sales price in June was $147,333, up 6.1 percent from last June. The June median sales price rose 11.2 percent when compared to May. Historical data indicate the June median sales prices increased 1.5 percent from the month of May from 2012 through 2016. Pricing can fluctuate from month to month as the sample size of data is subject to seasonal buying patterns. ACRE highly recommends consulting with a local real estate professional to discuss prices, which can vary from neighborhood to neighborhood.

Industry perspective: “While second-quarter growth is poised to rebound, we expect growth to moderate through the remainder of 2017. Consumer spending, traditionally the largest contributor to economic growth, is sluggish and is lagging positive consumer sentiment and solid hiring,” said Fannie Mae Chief Economist Doug Duncan. “While labor market slack continues to diminish, wage growth is not accelerating and inflation has moved further below the Fed’s target. These conditions support our call that the Fed will continue gradual monetary policy normalization, announce its balance sheet tapering policy in September, and wait until December for additional data, especially on inflation, before raising the fed funds rate for the third time this year.”

Click here to generate more graphs from the Mobile June Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Mobile Area Residential Monthly Report is developed in conjunction with the Mobile Area Association of Realtors to better serve Gulf Coast consumers.