November home sales increase 7 percent from October in Birmingham area

Year to date, Birmingham-area sales are up 1.3 percent from 2016. (iStock)

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

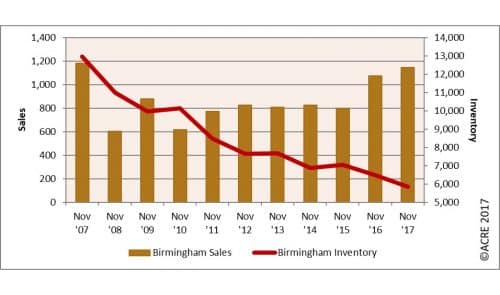

Sales: According to the Greater Alabama Multiple Listing Service, Birmingham metro-area residential sales totaled 1,146 units during November, representing a 6.7 percent increase from November 2016, when 1,074 homes were sold. November residential home sales increased by 7 percent from October. Year to date, Birmingham-area sales are up 1.3 percent from 2016. Two more resources to review: Quarterly Report and Annual Report.

For all of the Birmingham area’s housing data, click here.

Forecast: November sales were 5.6 percent above the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE’s 2017 sales forecast through November projected 14,096 closed transactions, while the actual sales were 13,808 units. Year-to-date sales for the Birmingham metro area are 2 percent below ACRE’s forecast.

Supply: The Birmingham-area housing inventory in November totaled 5,842 units, a 10 percent decrease from November 2016 and down 55 percent from the November peak in 2007 (12,979 units). November inventory in the Birmingham metro area decreased by 4 percent from October. According to the Greater Alabama MLS, in the Birmingham metro-area market, there were 5.1 months of housing supply during November, a 10.3 percent decrease from the previous month. The “months of housing supply” is a simple calculation – homes listed (supply) divided by homes sold (demand). Generally speaking, the market is in balance at 6 months of supply.

Demand: November residential sales increased 7 percent from the prior month. Historical data indicate that November sales, on average (2012-16), decrease from October by 10.6 percent. Existing single-family home sales accounted for 85 percent of Birmingham-area transactions, while 12 percent were new construction and 3 percent were condo sales. Sales closing in November averaged 68 days on the market, an increase of 9.7 percent from the previous month.

Pricing: The median sales price in November was $188,950, a decrease of 0.3 percent from November 2016 ($189,450). The November median sales price decreased 4.6 percent from October. This trend is consistent with historical data (2012-16) which indicate that the November median sales price on average decreases 2.8 percent from October. Pricing can fluctuate from month to month as the sample size of data is subject to seasonal buying patterns. ACRE recommends consulting with a local real estate professional who has access to pricing data at the neighborhood level.

Industry perspective: “The economy and real estate markets continue to show they are resilient. Regardless of the economic metric — GDP, monthly jobs or home prices — the dashboard registers an ‘all-systems-go’ economy,” said KC Conway, director of research and corporate engagement at the Alabama Center for Real Estate. “GDP started the year off with its best Q1 reading in several years and followed it up with above 3 percent readings for Q2 and Q3. (This year) will be the first year since the financial crisis that the economy registered an annual GDP greater than 2 percent. It was just plus 1.6 percent for 2016.

“Job growth is healthy as well. The first week of December the market received solid monthly jobs reports from both ADP (which measures private industry job formation) and the BLS (the government’s monthly jobs report produced by the Bureau of Labor Statistics). ADP reported a healthy new 190,000 private-sector jobs for November and a monthly average of 210,000 jobs over the prior 12 months. The BLS reported November jobs at a higher-than-expected level of 228,000 jobs – and its year-to-date monthly average is 174,000. Unemployment remains low at 4.1 percent, and inflation was just reported on December 13th at 1.7 percent for the “core rate” (which excludes the more volatile food and energy components) and 2.2 percent overall annualized due to higher energy prices.

“The Federal Reserve is taking note of the expanding economy and followed up its prior two rate hikes earlier in 2017 with a 0.25 percent rate increase at its December 13th meeting. Housing conditions remain conducive to growth in new supply and more transaction activity. Single-family home inventories are below demand levels across the nation, Southeast and most Alabama markets. The national rate of appreciation is running above 6 percent on the heels of 5-plus percent in 2016. This is leading builders and lenders to be more receptive to adding inventory. New housing starts and permits will likely end 2017 at or above the 1.3 million units level, split 30 percent multifamily and 70 percent single-family. The outlook heading into 2018 is the best we have seen in a decade.”

Click here to generate more graphs from the Birmingham November Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Birmingham Residential Monthly Report is developed in conjunction with the Greater Alabama MLS and the Birmingham Association of Realtors to better serve Birmingham metro-area consumers.