Birmingham-area home sales up 11.5 percent in April from prior month

The Birmingham-area median home sales price in April was $223,000, an increase of 13.2 percent from one year ago. (file)

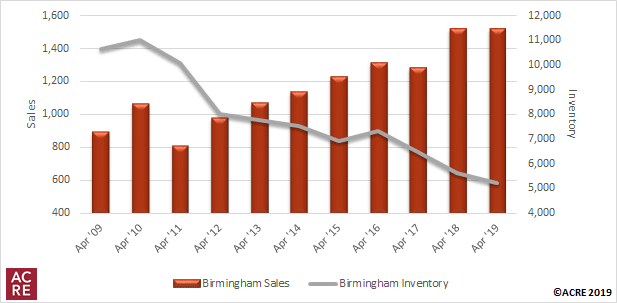

Sales: According to the Greater Alabama Multiple Listing Service, Birmingham-area residential sales totaled 1,513 units during April, equivalent to 1,513 sales in the same month a year earlier. April sales were up 11.5 percent compared to 1,357 sales in March. Results were 17.2 percent above the five-year April average of 1,291 sales. Two more resources to review: Quarterly Report and Annual Report.

For all Birmingham-area home sales data, click here.

Inventory: Total homes listed for sale in the Birmingham area during April were 5,213 units, a decrease of 7.4 percent from April 2018’s 5,367 units and an increase of 5.1 percent from March 2019’s 4,958 units. April months of supply totaled 3.4 months, a decrease of 7.4 percent from April 2018’s 3.7 months of supply. April’s months of supply also decreased 5.7 percent from March’s 3.7 months of supply.

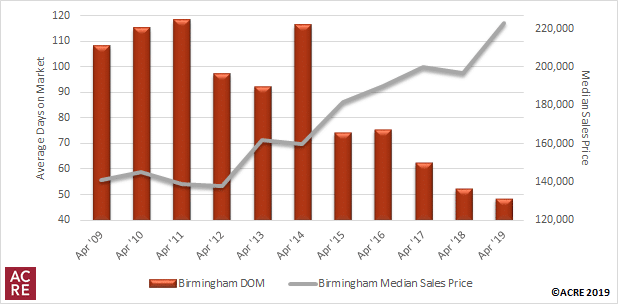

Pricing: The Birmingham-area median sales price in April was $223,000, an increase of 13.2 percent from one year ago and an increase of 4.2 percent from the prior month. This is consistent with historical data indicating that the April median sales price on average (2014-18) increases 9 percent from March. The differing sample size (number of residential sales of comparative months) can contribute to statistical volatility, including pricing. ACRE recommends consulting with a local real estate professional to discuss pricing, as it will vary from neighborhood to neighborhood. The average number of days on the market (DOM) for homes sold during April was 48 days, a decrease of 7.7 percent from 52 days in April 2018 and a decrease of 4 percent from 50 days in March.

Forecast: April sales were 41 units, or 2.8 percent, above the Alabama Center for Real Estate’s (ACRE) monthly forecast. ACRE projected 1,472 sales for the month, while actual sales were 1,513 units. ACRE forecast a total of 4,962 residential sales in the Birmingham area year-to-date, while there were 4,777 actual sales through April.

ACRE’s statewide perspective: While nationwide residential sales dropped 8 percent in March, demand for housing in Alabama remained strong. Statewide residential sales increased slightly (0.02 percent) from 5,341 closed transactions in March 2018 to 5,342 in March 2019. Year-to-date, sales increased 3.6 percent from 2018. Home price appreciation in the state continued to climb but at a slower pace as the median sales price in March increased 2.6 percent year-over-year from $158,617 to $162,759. The statewide median sales price is also up 3.6 percent year-to-date. Although nationwide inventory levels are trending upward, Alabama’s residential listings decreased 11.3 percent from one year ago. Low inventory levels were a significant factor contributing to rising sales prices throughout 2018 and in the spring buying season of 2019. With low inventory levels, it is not surprising to see homes selling more quickly than in previous years. Homes selling in Alabama during March spent an average of 99 days on the market, an improvement of 19 days from March 2018.

NAR’s national perspective: During March, total existing-home sales nationwide declined 7.8 percent from approximately 434,000 closed transactions one year ago to 400,000 currently. The nationwide median existing-home price increased 3.8 percent in March, marking 85 consecutive months of year-over-year gains. Lawrence Yun, chief economist for the National Association of Realtors, said, “It is not surprising to see a retreat after a powerful surge in sales in the prior month. Still, current sales activity is underperforming in relation to the strength in the jobs markets. The impact of lower mortgage rates has not yet been fully realized.”

Click here to view the entire monthly report.

The Birmingham Residential Monthly Report is developed in conjunction with the Greater Alabama MLS and the Birmingham Association of Realtors to better serve Birmingham metro-area consumers.