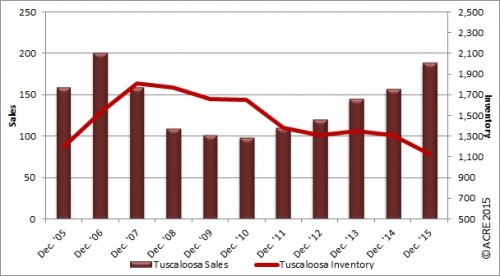

Tuscaloosa ends 2015 with strong home sales

Click here to view or print the entire monthly report compliments of the ACRE Corporate Cabinet.

Sales: According to the Tuscaloosa MLS, Tuscaloosa area residential sales totaled 188 units during December, which was up 20.5 percent from the same period last year. Year-to-date sales through December were up 10.3 percent from 2014. Two more resources to review: Quarterly Report and Annual Report.

For all of the Tuscaloosa area’s housing data, click here.

Sales came close to a new December peak in 2015, just shy of 200 reached in 2006.

Forecast: December results were 44 units or 30 percent above our monthly forecast. ACRE’s year-to-date sales forecast through December projected 2,088 closed transactions while the actual sales were right on the mark at 2,122 units.

Supply: Tuscaloosa December housing inventory totaled 1,128 units, a decrease of 14 percent from December 2014. December inventory dipped 6.2 percent from the prior month. Historical data indicates that December inventory on average (2010-’14) decreases from the month of November by 5.4 percent. Inventory has now declined 37.8 percent from the month of December peak (1,813 units) reached in 2007.

Seeking balance: The inventory-to-sales ratio declined 29 percent year-over-year during December to 6 months. Restated, at the December sales pace, it would take 6 months to absorb the current inventory for sale. The market equilibrium (balance between supply and demand on non-seasonally adjusted basis) is considered to be approximately 6 months during month of December, making Tuscaloosa one of the most balanced Alabama markets during the final month of 2015.

Demand: December residential sales were 47 percent above the prior month. The decrease is consistent with seasonal buying patterns and historical data indicating that December sales on average (2010-’14) increase from the month of November by 11.6 percent. Existing single family home sales accounted for 79 percent (unchanged from December 2014) of total sales while 13 percent (up from 10 percent during December 2014) were new home sales and 8 percent (down from 10 percent in December 2014) were condo buyers.

Pricing: The Tuscaloosa median sales price in December was $158,000, a decrease of 3.3 percent when compared to December 2014. The median sales price rose 4.5 percent from November’s price. This month-over-month price direction is consistent with historical data indicating that the December median sales price on average (2010-’14) increases from the month of November by 1.5 percent. It should also be noted that differing sample size (number of residential sales of comparative months) can contribute to statistical volatility including pricing. The Center highly recommends consulting with a real estate professional to discuss pricing as it can and will vary from neighborhood to neighborhood.

Industry Perspective: From Nathan Dendy of Keller Williams Tuscaloosa: “Since the spring, Tuscaloosa has seen a decline in both sales numbers and inventory. I expect this trend will reverse in the 1st quarter of 2016, and Tuscaloosa will see a gradual increase in sales and inventory .”

The Tuscaloosa Residential Monthly Report work product developed in conjunction with the Tuscaloosa Association of Realtors to better serve West Alabama consumers. The ACRE monthly report is provided to illustrate the “general” market direction & trends when comparing prior periods with the most current residential data available. Real estate is local and statistics will fluctuate between areas within a city including subdivisions, and ACRE recommends that you consult a local real estate professional for “specific” advice associated with your market. The Alabama Center for Real Estate‘s core purpose is to advance the real estate industry in Alabama by providing relevant resources in the areas of research, education and outreach. Join the Center mailing list here.