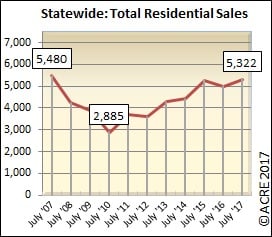

Statewide home sales in July climb 7 percent over last year

Actual home sales are far ahead of sales forecasts in Alabama so far this year. (iStock)

Click here to view or print the entire monthly report compliments of the Alabama Center for Real Estate Corporate Cabinet. Join the Center mailing list here.

Sales: Alabama home sales totaling 5,322 units during July were an increase of 6.6 percent from the same month a year ago. Two more resources to review: Quarterly Report and Annual Report.

Forecast: July sales were 6.7 percent or 2,156 units above the Alabama Center for Real Estate‘s (ACRE) monthly forecast. ACRE’s 2017 sales forecast through July projected 31,844 closed transactions, while the actual sales were 34,000 units.

Forecast: July sales were 6.7 percent or 2,156 units above the Alabama Center for Real Estate‘s (ACRE) monthly forecast. ACRE’s 2017 sales forecast through July projected 31,844 closed transactions, while the actual sales were 34,000 units.

Supply: The statewide housing inventory during July was 27,743, a decrease of 9 percent from July 2016 and 36 percent below the July peak in 2008 (43,057 units). There were 5.2 months of housing supply in July (6 months is considered equilibrium), which represents a drop of 14.6 percent from July 2016 (6.1 months).

July inventory increased from June by 35 percent. This direction is consistent with historical data that indicate July inventory on average (2012-16) increases from June by 0.1 percent.

Seeking balance: The metro markets in Alabama representing 70 percent of all sales continued to trend toward greater seller bargaining power with 4.6 months of supply. Outside the metro markets, Alabama’s midsized markets are reporting 5.4 months of supply, while rural areas are reporting 8.2 months of supply. There have been significant improvements from inventory peaks experienced during the recession. The supply of quality inventory in the past has affected sales, according to some boots-on-the-ground professionals.

Industry perspective: “We are keeping our full-year economic growth outlook at 2 percent as risks to our forecast are roughly balanced,” said Fannie Mae Chief Economist Doug Duncan. “On the upside, consumer spending growth might not moderate as much as we have accounted for in our forecast. A build-up in inventory also should be positive for growth this quarter, and nonresidential investment in structures will likely continue to improve as oil prices stabilize.”

Click here to generate more graphs from the Alabama July Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Alabama Residential Monthly Report is developed in conjunction with the Alabama Association of Realtors and its local associations.