Challenges met on Wall Street and in Washington define career of Alabama’s Mary Kate Bush

Mary Kate Bush at the White House with President George H.W. Bush and First Lady Barbara Bush. (contributed by Mary Kate Bush)

A native of Birmingham who grew up during the era of segregation, Mary Kate Bush went on to a life and career of global reach and influence. This is Part 2 of her story; the third and final segment will run Tuesday, Aug. 31.

It was 1982. Mary Kate Bush, after more than a decade rising steadily through the ranks of Wall Street banking, accepted an appointment as special assistant to the deputy secretary of the United States Treasury. Less than two months later, Bush, then 35, found herself at a conference table that included Treasury Secretary Donald Regan, Federal Reserve Chair Paul Volcker and other high-ranking government officials.

“I was flabbergasted,” Bush remembered. “I had to stop and ask myself, ‘How did I get here?'”

The power of being different

Bush’s journey began in segregated Birmingham. After graduating from Ullman High School in 1965 – her final two years of high school were the first two of integrated schools in the city – she went to Fisk University in Nashville, one of the top historically Black colleges in America. At Fisk, Bush took a double major in economics and political science but discovered quickly where her real interest lay.

RELATED: For Birmingham native Mary Kate Bush, the focus was always ‘keep moving forward’

“I just fell in love with this business thing,” Bush said, laughing as she recalled that beyond the business-oriented coursework in economics, her studies included a class in which students started a small business that served the surrounding neighborhood. She had visited the University of Chicago (now Chicago Booth School of Business) on a field trip from Fisk, and after briefly considering law school – “I have to admit, as much as I’d always loved school, I liked the idea of just two more years to a graduate degree, rather than three” – she decided to pursue her MBA at Chicago, where more faculty members have received Nobel Prizes in that discipline than any other university.

Mary Kate Bush talks about her time on Wall Street that led to working for three U.S. presidents from Alabama NewsCenter on Vimeo.

Bush was particularly engaged by her courses in finance and investments, of which she became an adept student. She knew she wanted to work in that field, and though she received offers from major corporations that wanted her to start in other areas, she narrowed the choice to “two or three” Wall Street firms. In the fall of 1971, Bush went to work as a credit analyst for Chase Manhattan Bank.

Entering the workforce, Bush was part of the first major wave of racial, ethnic and gender diversity in corporate America. As a Black woman, she faced special challenges to her strong desire to advance in her chosen profession. But though she certainly encountered instances of bias, Bush also received strong support and encouragement that helped keep things in perspective – and keep her focused on objectives at hand.

“Were there challenges? Most definitely,” Bush reflected of her time on Wall Street. “Especially early on, I was a definite anomaly. But all in all, it was a wonderful experience. I found that when you’re dealing with people, you have to look past the outer shell.”

Over the next 11 years, Bush worked in positions of increasing responsibility for Chase, Citibank and Bankers Trust Company. At Citibank, she managed the accounts of several Fortune 100 companies that were clients of the bank, as well as the Wrigley Company, the Chicago-based chewing gum maker.

Mary Kate Bush as a student at Fisk University. (courtesy of Mary Kate Bush)

Bush remembered visiting Wrigley’s corporate offices for the first time and meeting with the company’s chief financial officer a few months after taking charge of the account, following several productive telephone conversations. Ushered into the office by an assistant, she encountered a man utterly taken aback.

“He was sitting behind a big, beautiful mahogany desk,” Bush recalled. “His mouth actually fell open. He collected himself and said, ‘I’m sorry, I don’t mean to stare. It’s just that I’ve never seen this before.’ It was already a new experience for him, dealing with women, so to see a Black woman was pretty shocking to him.”

Bush laughed. “And then we went on and had a wonderful meeting.”

In fact, Bush added, as she was leaving, the man told her that on her next visit to Chicago, he wanted her to meet P.K. Wrigley, the company’s octogenarian retired CEO. She would, in fact, meet Wrigley, but, riding the elevator down after the conversation with the CFO, Bush knew that a point had been made – and a lesson learned – already.

“How many people could have gotten a meeting with P.K. Wrigley like that?” Bush asked. “I realized that being ‘different’ can make a positive difference as well.”

Attention to detail

Bush was a vice president at Bankers Trust on the day in 1982 when she received a call from the Treasury Department: Would she be interested in an appointment as chief assistant to the department’s second in command?

“I said, ‘This is very flattering, but no, thank you,'” Bush said. “I loved what I was doing, and I really knew nothing about Washington or politics. Luckily, they continued to call.”

After talking to a few people who had done stints in the nation’s capital – “Basically, they said, ‘Do you know how many people would kill to be offered this job?'” – Bush accepted the appointment. She quickly became known for her attention to even the smallest details of a given policy decision, working primarily on measures to address the Latin American debt crisis of the early 1980s.

Bush planned to spend two years in the job and then go back to New York and banking. But both Secretary Regan and the White House prevailed on her to become the U.S. alternate executive director of the International Monetary Fund. Bush agreed, and she was appointed by President Ronald Reagan and confirmed by the Senate.

“Debt in developing countries was an ongoing, global problem,” Bush said. When offered the appointment, she remembered, “I pointed out that they had all these economists and Ph.D.’s at their disposal and they said, ‘We need your banking experience.’ I was reluctant to take it, but I’m very glad I did, because I got to keep working on that crisis.”

During her four years at the IMF – she was appointed to a second two-year term in 1986 – Bush was deeply engaged in coordinating the efforts of the organization with those of the World Bank, leading global financial institutions, the Treasury Department, and other U.S. government agencies. The debt crisis was “a massive problem” that required unprecedented cooperation between government agencies, international organizations, and the world’s biggest banks.

“We had to do something that had never been done before,” said Bush. “It was a huge negotiating process and a fantastic experience.”

Mary Kate Bush meets with officials from Bulgaria during her time with the International Monetary Fund. (courtesy of Mary Kate Bush)

Bush moved next to the Federal National Mortgage Association (Fannie Mae) as vice president for international finance. She recruited major new institutional investors that had not previously invested in Fannie Mae securities and worked with Wall Street to create the first mutual fund of Fannie Mae mortgage-backed securities – a transaction of well over $1 billion in 2021 dollars.

In 1989, President George H.W. Bush called on Mary Bush to help respond to the escalating savings and loan crisis. She spent two years as head of the Federal Home Loan Bank system, which provides cash to other financial institutions to ensure access to credit for consumers and businesses and is the primary source of funding for the S&L industry. Again, she was charged with coordinating the efforts of various agencies to stem a building avalanche of S&L failures that would contribute to the recession of 1990-91.

“It was a major challenge,” said Bush. “We wanted to save S&Ls, while also keeping our Federal Home Loan Banks healthy. Today, that system is very healthy, and the S&L industry is on much better footing, so I think we managed.”

Renewing a friendship

Having been instrumental in innovations and reforms that mitigated the impacts of the S&L crisis and positioned the FHLB system for long-term stability, Bush left the agency in 1991. Now a confirmed resident of the nation’s capital, she established Bush International, a consultancy providing guidance to U.S. companies and foreign governments on international finance markets, banking and global business strategy.

By that time, Bush had also renewed a friendship from her childhood in Birmingham. Early in her time at FHLB, she heard from a woman who had worked under her at the IMF and was now at the White House, working for the newly appointed special assistant to the president for national security affairs. The woman’s new boss was also from Birmingham, she said, so she was curious whether Bush might know Condoleezza Rice.

“We’ve been together ever since,” Bush said of her reunion with the daughter of the Rev. John Rice, who had played an influential role in her youth. The two quickly formed an enduring bond that continues to the present – even when they have been on opposite coasts, with Rice at Stanford University from the end of the “Bush 41” administration in 1993 until President George W. Bush took office in 2001, and since the “Bush 43” administration ended in 2009.

“It’s been like having a sister,” Bush remarked. “When Condi and I were both in D.C., we had the most wonderful, family-like time and relationship. And we still do. We spend some holidays and vacations together, and we both love golf, so we play together whenever we can.”

Continuing to serve

When George W. Bush took office, a recruitment of sorts took place, with the goal of getting Mary Bush back into government. Bush recalled meeting the new president at a formal dinner.

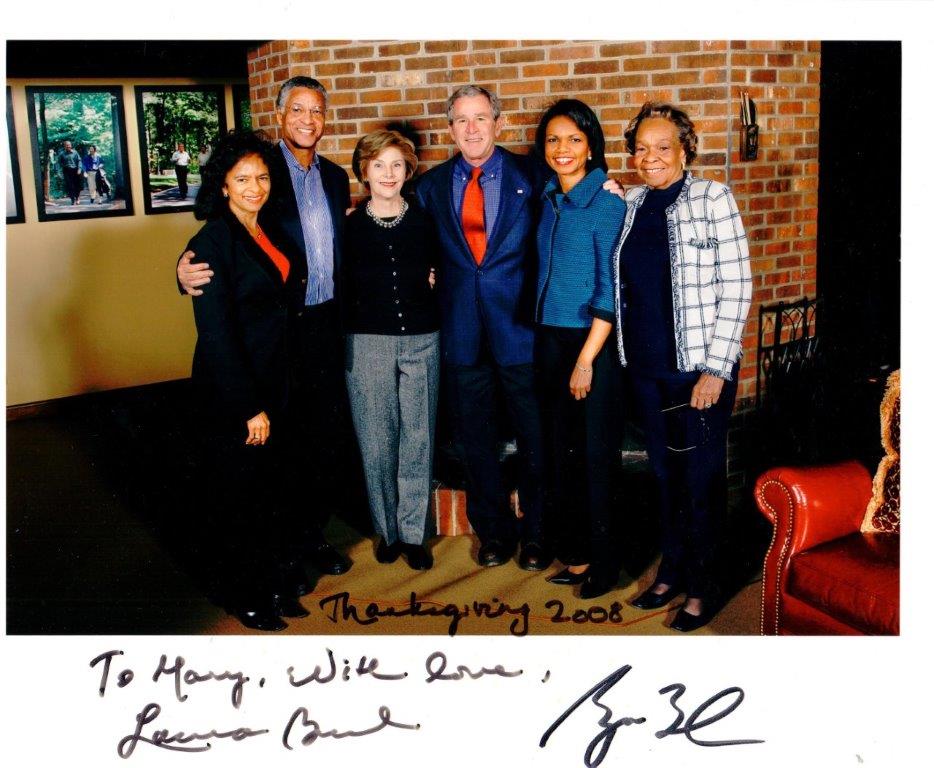

Mary Kate Bush, former NFL player Gene Washington, then Secretary of State Condoleezza Rice, and Rice’s mother, Angelena, celebrate Thanksgiving 2008 with President George W. and First Lady Laura Bush. (courtesy of Mary Kate Bush)

“Someone had arranged that he and I would sit next to each other,” she said. “We just had a ball, because he is so very funny. But we also talked about all kinds of issues, foreign and domestic. I was impressed with how down-to-earth he is.”

The president offered Bush the job of deputy Treasury secretary – the same job her first boss in Washington had held two decades earlier. They discussed similar positions in the Commerce or Defense departments. With a busy consulting career and other commitments, she declined.

“I had done two stints in government,” said Bush. “I decided I could not go back full time.”

Instead, the president took advantage of Bush’s banking and finance expertise by appointing her to the board of Sallie Mae (the Student Loan Marketing Association). Early in 2006, he made her chair of the HELP Commission, which was charged with recommending ways to improve outcomes of the $30 billion the U.S. then distributed in direct aid to foreign countries.

The commission’s report was issued in December 2007. Among its key recommendations was the development of initiatives focused on long-term, sustainable economic growth – in Bush’s words, “more investing than giving.”

Bush also became a close friend of the president and his family. She was regularly invited to the White House to watch movies with the president and first lady and spent “two or three” Thanksgivings with the Bush family at Camp David. Asked to share a humorous anecdote of those times, Bush instead recalled a Thanksgiving when the demands on the president were weighing heavily on her friend. The first couple and their guests were at a long dining table when Laura Bush pointed out that they had not held to the usual practice of each person at the table naming something for which they were thankful.

“He looked up, and you could see how very tired he was,” Bush said. “He said, ‘I’m thankful for you, baby.’ And I thought, ‘That’s so touching.’ Reflecting on that, I think it shows the kind of person he is.”