Mobile-area September home sales up 18 percent over same month last year

Click here to view or print the entire September report compliments of the ACRE Corporate Cabinet.

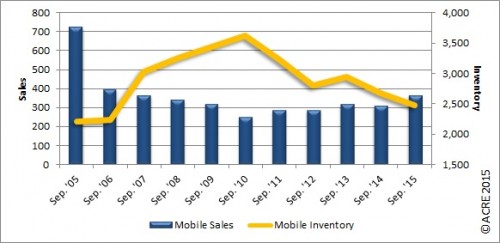

Sales: According to the Gulf Coast Multiple Listing Service, Mobile-area residential sales totaled 363 units in September, an increase of 18 percent from the same period last year (308 units). Year-to-date sales through September are up 14.6 percent from 2014. Two more resources to review market: Quarterly Report and Annual Report.

Forecast: September sales were 24 units, or 7 percent, above our monthly forecast. The Alabama Center for Real Estate’s (ACRE) year-to-date sales forecast through September projected 3,177 closed transactions, while the actual sales were 3,320 units, an increase of 4.5 percent.

Mobile are residential sales increased 18 percent over last September. Inventory also down 21.3 percent from last year.

Supply: The Mobile-area housing inventory in September was 2,479 units, a decrease of 7.3 percent from September 2014. Inventory has now declined 31.5 percent from September peak (3,617 units) reached in 2010. There was 6.8 months of housing supply in September 2015 (6.0 months represents a balanced market for this time of year) versus 8.7 months of supply in September 2014, a favorable decline of 21.3 percent. The market continues to move toward equilibrium, where buyer and seller have equal bargaining power, which is encouraging news.

September inventory in the Mobile area also decreased 2.2 percent from the prior month. This movement is consistent with historical data indicating that September inventory on average (2010-14) decreases by 1.0 percent from August. As seller confidence in the housing market continues to gradually strengthen, more listings for sale can be anticipated in the future, including more new home construction. This is important because the “quality” of inventory has become a market impediment, according to recent surveys.

Demand: September sales decreased 8.1 percent from the prior month. This direction is consistent with historical data, which indicates sales, on average (2010-14), decrease from August by 3.3 percent.

Existing single-family home sales accounted for 91 percent (up from 89 percent in September 2014) of total sales, while 7 percent (down from 8 percent in September 2014) were new home sales and 2 percent (down from 3 percent in September 2014) were condo transactions.

Pricing: The Mobile area median sales price in September was $125,500, up 0.5 percent from last September. Also, the September median sales price increased 9 percent when compared to the prior month. This month-over-month direction is consistent with historical data (2010-14) indicating, on average, September median sales prices increase from August by 2.1 percent. Pricing can fluctuate from month to month as the sample size of data (closed transactions) is subject to seasonal buying patterns. ACRE highly recommends consulting with a local real estate professional to discuss prices, which can and will vary from neighborhood to neighborhood. The 2014 Mobile-area median sales price improved 5.7 percent from 2013.

Industry Perspective: “Our forecast for the year is largely unchanged despite recent market volatility. Fundamentals are positive, suggesting potential for some improvement in the fourth quarter,” said Fannie Mae Chief Economist Doug Duncan. “While core personal consumption expenditures experienced their weakest gain in more than four years in July, real consumer spending rebounded during the month and August auto sales were stronger than they have been in a decade. Consumers may get an added boost during the year from subdued inflation given the stronger dollar and low oil prices. Overall, we anticipate economic growth of 2.4 percent for 2015, up slightly from 2.1 percent in the prior forecast. Consumer and government spending as well as nonresidential and residential investment are expected to contribute to growth, while net exports and inventory investment will likely pose headwinds.” For full report click here.

###

Bryan Davis is the research/media coordinator for the Alabama Center for Real Estate housed within the Culverhouse College of Commerce at the University of Alabama. He can be reached at 205-348-5416 or at bkdavis@culverhouse.ua.edu.

The Mobile Area Residential Monthly Report is work product developed in conjunction with the Mobile Area Association of REALTORS to better serve gulf coast consumers. The ACRE monthly report is provided to illustrate the “general” market direction & trends when comparing prior periods with the most current residential data available. Real estate is local and statistics will fluctuate between areas within an area including subdivisions, and ACRE recommends that you consult a local real estate professional for “specific” advice associated with your market. The Alabama Center for Real Estate‘s core purpose is to advance the real estate industry in Alabama by providing relevant resources in the areas of research, education and outreach. Join the Center mailing list HERE.

– See September home sales for Birmingham, Tuscaloosa, Dothan and Gulf Coast condos.