Tuscaloosa May home sales up 6 percent from 2017

The Tuscaloosa median home sales price in May was $177,000. (ACRE)

Click here to view or print the entire monthly report.

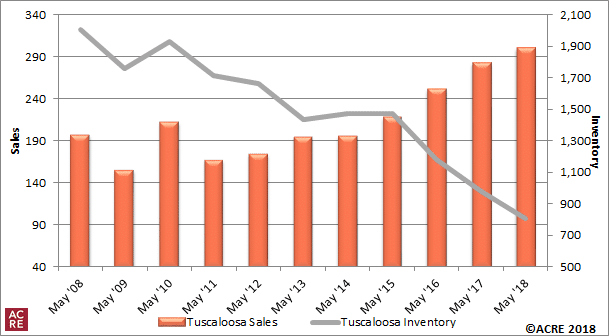

Sales: According to the Tuscaloosa MLS, Tuscaloosa-area residential sales totaled 299 units during May, up 6 percent from 282 homes sold during May 2017. Existing single-family homes accounted for 80 percent of residential sales, while condos represented 10 percent and newly constructed homes accounted for 10 percent. Two more resources to review: Quarterly Report and Annual Report.

For all of the Tuscaloosa area’s housing data, click here.

Forecast: May results were 28 units or 10.3 percent above the Alabama Center for Real Estate’s monthly forecast. ACRE’s 2018 sales forecast projected 1,079 closed transactions during the first five months of the year, one transaction more than the 1,078 actually sold.

Supply: Tuscaloosa’s May housing inventory totaled 803 units, a decrease of 17.7 percent from May 2017. May inventory decreased by 1.6 percent from the prior month. Inventory has now declined 60 percent from the May peak (2,008 units) reached in 2008.

Seeking balance: The inventory for sale divided by the current monthly sales volume equals the number of months of housing supply. The market is considered to be in balance at approximately 6 months. The Tuscaloosa area has 2.7 months of housing supply, down from 3.7 months of supply during the previous month and down from 3.5 months at this time last year.

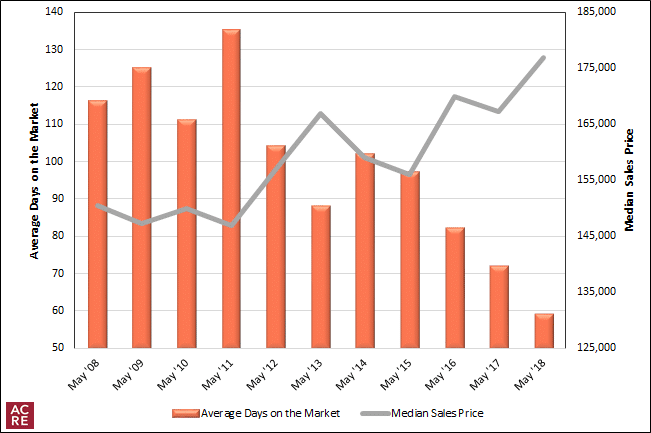

Demand: May residential sales were 34.1 percent higher than the prior month. Historical data indicate that May sales on average (’13-’17) increase from April by 19.8 percent. Tuscaloosa-area homes selling in May averaged 59 days on the market, a decrease of 18.1 percent from 2017. The five-year average for days on the market for May home sales is 88 days.

Pricing: The Tuscaloosa median sales price in May was $177,000, an increase of 5.8 percent compared to May 2017. The median sales price was up 1.4 percent from April. Historical data indicate that May median sales prices on average (2013-2017) increase by 5.7 percent from April. It should be noted that differing sample size (number of residential sales of comparative months) can contribute to statistical volatility, including pricing. Consult with a real estate professional to discuss pricing, as it will vary from neighborhood to neighborhood.

Industry perspective: In both Alabama and the United States, the spring home-buying season has been affected greatly by very low inventory levels. April residential listings decreased 10 percent in the state and decreased 6 percent nationwide from one year ago. Residential sales in Alabama, however, increased 16 percent from one year ago, which is impressive considering the 10 percent drop in inventory. Home price appreciation cooled off somewhat as the statewide median sales price increased 2 percent from one year ago, while it increased 7 percent during the first quarter of the year. Going forward, home sales prices are expected to continue their upward climb during the summer as inventory levels are likely to repeat the declines that were seen during the spring.

Click here to generate more graphs from the Tuscaloosa Monthly Housing Report, including Total Sales, Average Sales Price, Days on the Market, Total Inventory and Months of Supply.

The Tuscaloosa Residential Monthly Report is developed in conjunction with the Tuscaloosa Association of Realtors to better serve West Alabama consumers.